-

2014

2014

Annual Report

The year 2014 has been a favorable year for the insurance market and even more so for La Positiva Seguros. Our main insurance lines registered a growth above the average of the industry, which is reflected in the increase in equity and profit of the group.

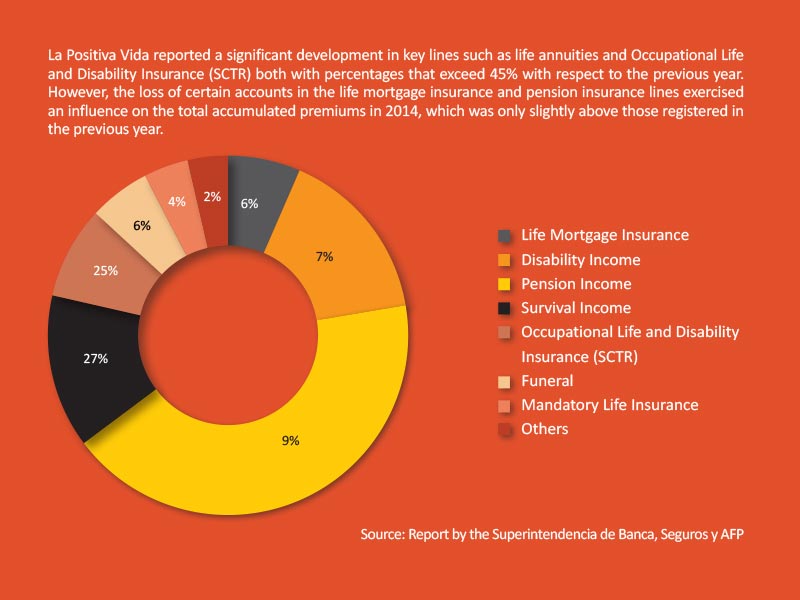

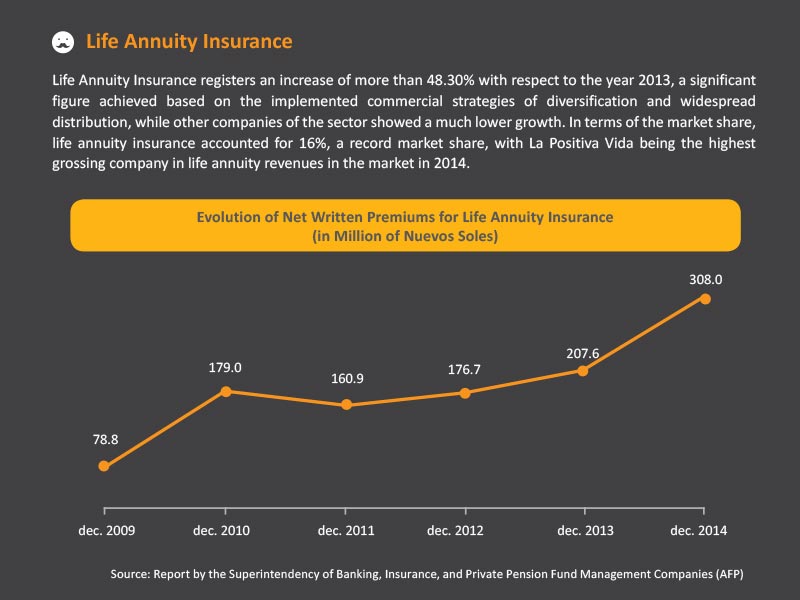

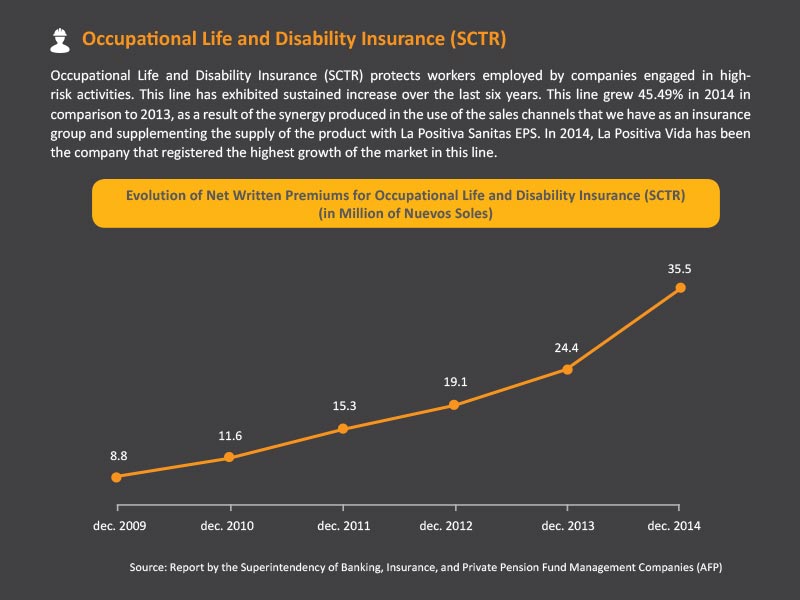

La Positiva Vida Life Annuities rose by 48% with respect to the previous year, thereby making us the Company with the largest growth in said line of the market, contributing to the production of our insurance group in the first place. Another significant result was achieved by the Occupational Life and Disability Insurance (SCTR) that grew by more than 49% in comparison to the previous year.

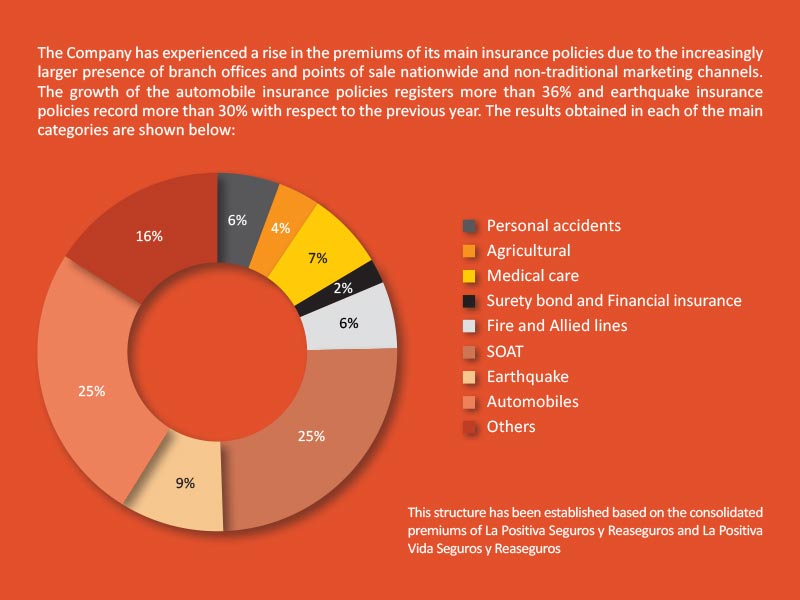

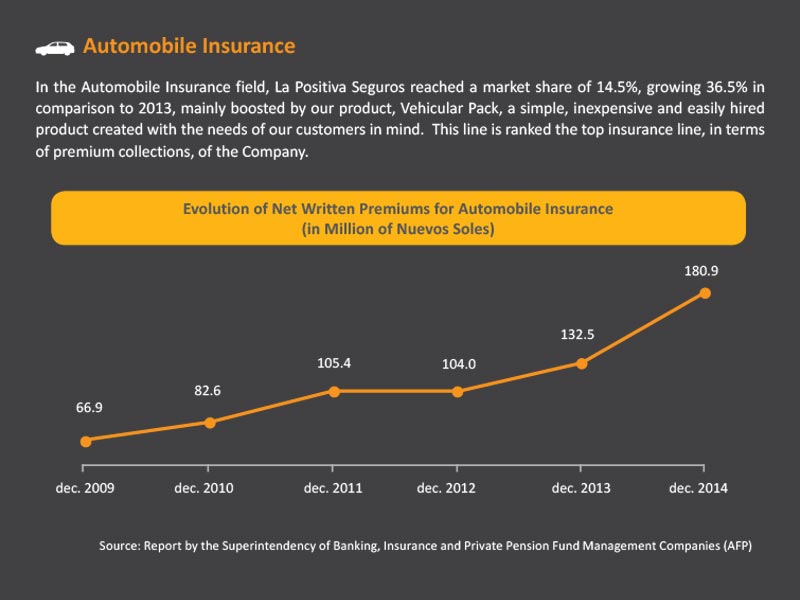

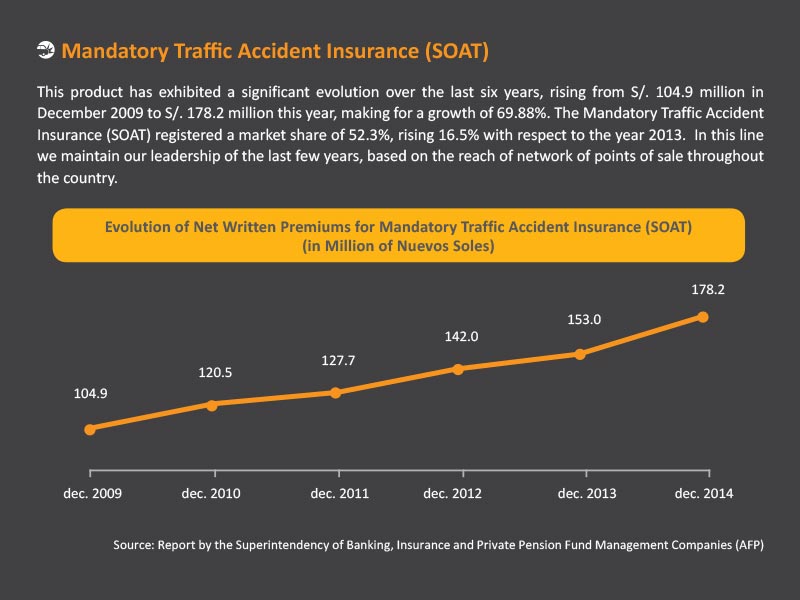

La Positiva Seguros Generales (Property and Casualty) has experienced the most important development in the automobile insurance market, growing 37% due mainly to the launch of our product Vehicular Pack, designed to allow the customers to hire the covers they require according to their needs. Furthermore, the Mandatory Traffic Accident Insurance (SOAT) grew 16% with respect to the previous year, thereby allowing us to maintain our leadership in time, with a market share of over 52%.

This auspicious panorama of the insurance market was not necessarily accompanied by the good economic performance of the country. In 2014, the main macroeconomic indicators registered a reduction and stagnation influenced by a yet unfavorable international scenario and the drop in the prices of the main commodities exported by Peru.

However, our commitment towards the development of Peru remains intact through the offer of insurance policies available to the large majorities, thereby making our presence more extensive throughout the country, through our customer service agencies and insurance promoters who permanently advise the millions of Peruvians who expect to be suitably protected in the event of a loss.

Juan Manuel Peña R.Letter to the Shareholders

In compliance with the provisions of the Business Corporations Act and our Bylaws, we hereby present for the information and approval of our Shareholders, the Annual Report for the financial year ended December 31, 2014. This report includes the Balance Sheet and the Profit and Loss Statement of La Positiva Seguros y Reaseguros and of La Positiva Vida Seguros y Reaseguros. These documents have been audited by the firm Dongo-Soria Gaveglio y Asociados Sociedad Civil de Responsabilidad Limitada, a member firm of the PricewaterhouseCoopers International Limited (PwCIL) network.

Acknowledgements

We at La Positiva Seguros y Reaseguros and La Positiva Vida Seguros y Reaseguros would like to express our appreciation to our insurance brokers, agents, and promoters for their invaluable assistance; and to our suppliers and reinsurers, for the trust placed in our Company. Likewise, we are grateful for the collaboration of our managers, officers, and employees, for their effort, teamwork, and sense of responsibility and professional excellence. We would especially like to express our sincerest gratitude to our customers, since they are the ones who enabled us to achieve the results submitted in this Annual Report.

Arequipa, March 2015We successfully completed the implementation of the first stage of the ERP-SAP System for the automation of processes.

We are the first group of insurers in Peru to have this management tool, with an important investment of more than US$15 million.

New customer-service branch offices were opened in Lima and in the provinces and we are the insurance company with largest number of self-owned branch offices in the country.

The joint net profit rose 101% in 2014 in comparison to 2013,

amounting to S/. 69.05 million.

During 2014, the Peruvian economy registered positive growth rates with a 2.35% increase in the Gross Domestic Product (GDP) thereby accumulating 16 years of continuous growth.

3.22% was the annual inflation rate, one of the lowest in South America.

The country risk was 182 points, below the average of Latin America which accounted for 508 points.

Investment in concession projects is calculated in US$ 10,551 billion.

Peru's net international reserves are equivalent to 30.5% of the Gross Domestic Product (GDP).

Public debt is equivalent to 19.7% of the Gross Domestic Product (GDP).

Net written premiums totaled S/. 10,154 billion.

The insurance sector grew by 12% in 2014, compared to 2013.

The Peruvian insurance market is now nearly 2 times its size in 2009.

51.5% of premiums correspond to property and casualty, accident, and illness insurance .

48.5% of premiums correspond to life insurance.

La Positiva Seguros has over 3.5 million insureds.

We rank 4th among insurance groups in Peru.

S/. 1,147 billion in premiums,S/. 479 million in net equity, and over S/. 3,421 billion in assets.

La Positiva Vida Seguros y Reaseguros captured a 8.7% market share in life insurance.

La Positiva Seguros y Reaseguros reached 13.8% market share in property and casualty.

La Positiva Seguros reached 11.3% market share of the Insurance market share and grew 11.6% as compared to 2013.

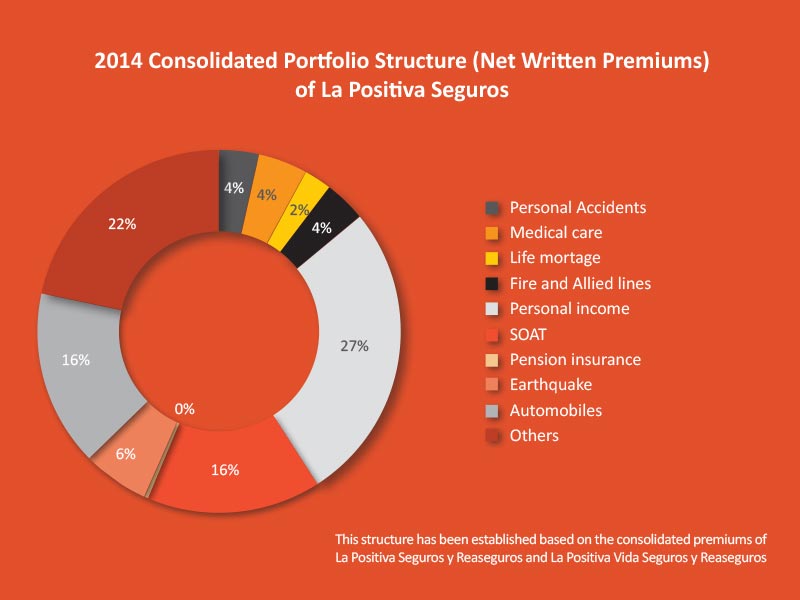

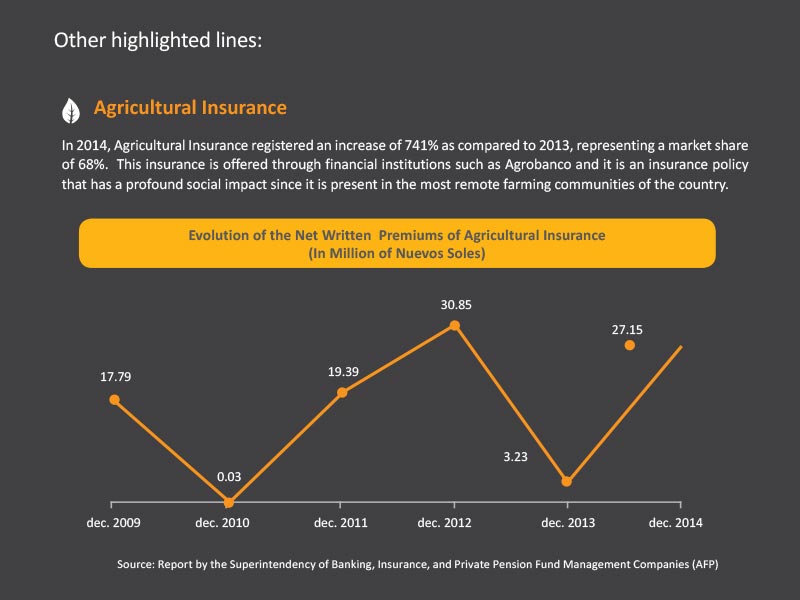

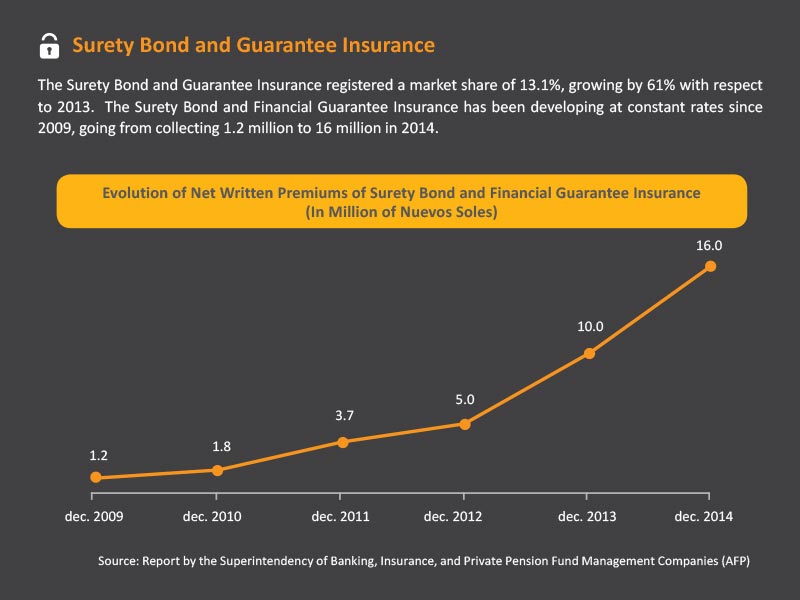

At La Positiva Seguros, we seek to protect businesses and people from economic losses caused by risks that affect their assets and their lives. For this reason, we work hard to offer a wide variety of insurances, such as: automobile insurance, Mandatory Traffic Accident Insurance (SOAT), fire insurance, theft and robbery, fidelity insurance, accident insurance, agricultural insurance, health insurance, including insurance for cancer and serious diseases, , life annuities, pension insurance, life mortgage insurance, occupational risks and individual life insurance, among others.

Thanks to the wide variety of products that we offer, our service, our network of decentralized offices nationwide, and the solidity and prestige our brand represents in the Peruvian insurance market, more Peruvians trust in us, allowing for sustained, orderly, and reliable growth in the future.

During 2014, we have carried out the following initiatives that have set the bar for activities of the La Positiva Seguros Group whose importance is reflected in the several stakeholders we work with.

San Isidro Branch

Javier Prado Este y Francisco Masías Nº 370, San Isidro, Lima

Dean Valdivia Branch

Dean Valdivia N° 175, San Isidro, Lima

Los Olivos Branch

Av. Carlos Izaguirre Nº 464, Los Olivos, Lima

Miraflores Branch

Av. Jorge Chávez N° 154 Of. 201, Miraflores, Lima

San Juan de Lurigancho Branch

Próceres de la Independencia N° 1895 - 1899, San Juan de Lurigancho, Lima

El Callao Special Office

Av. Sáenz Peña N° 184, Callao, Callao

Lince Special Office

Francisco Masías Nº 2811-2815, 2819-2823, Lince, Lima

San Miguel Special Office

Av. La Marina N°3299, Urb. Maranga, 3era etapa, San Miguel, Lima

Surco Special Office

Av. Los Próceres N° 1042-1044, C.C. Penta Mall Los Viñedos Oficina 12B y 13B, Surco, Lima

Santa Anita Special Office

Av. Carretera Central N° 111, C.C. Mall Aventura Plaza Santa Anita, Local LF-10, Ate, Lima

Bellavista Special Office

Av. Oscar R. Benavides N° 3866, Urb. El Aguila, C.C. Mall Aventura Plaza Bellavista, Local C-1012, Bellavista, Callao

Independencia Special Office

Av. Alfredo Mendiola N° 1400, C.C. Plaza Lima Norte, Local CF – 02B, Independencia, Lima

Arequipa Main Office

San Francisco Nº 301, Arequipa, Arequipa

Trujillo Office

Av. Los Angeles N° 407, Urb. California, Trujillo, La Libertad

Iquitos Office

Jr. Yavarí Nº 335 - 363, tiendas 07 y 08, Iquitos, Loreto

Chiclayo Branch

Av. Andrés Avelino Cáceres N° 301, esquina con Av. Sesquicentenario, Urb. Santa Victoria, Chiclayo, Lambayeque

Calle Manuel María Izaga 780-782-784, Chiclayo, Lambayeque

Chimbote Branch

Av. Francisco Bolognesi Nº 364-368, piso 1 y 2, Chimbote, Ancash

Cusco Branch

Lote 04, Manzana G. Urbanización Magisterio, Segunda Etapa – Cusco, Cusco

Huancayo Branch

Jr. Amazonas N° 686, Huancayo, Junín

Huánuco Branch

Jr. Crespo Castillo N° 511-513, Huánuco, Huánuco

Ica Branch

Av. Cutervo Mz. J-04, Lt. 014 - Ica, Ica

Juliaca Branch

N Jr. San Román ° 114, Juliaca, Puno

Piura Branch

Av. Grau 1515, Interior A-2, Piura, Piura

Pucallpa Branch

Jr. Atahualpa N° 780-790, Coronel Portillo, Ucayali

Arequipa Branch

Urbanización Magisterial II, Mz. E, Lt.12, Umacollo, Yanahuara, Arequipa

Ayacucho Branch

Jr. Los Andes N° 121, Huamanga, Ayacucho

Tarapoto Branch

Jr. Gregorio Delgado N° 383, Tarapoto, San Martín

Madre de Dios Branch

Av. Madre de Dios N° 638. Urb. Carlos F. Fitzcarrald, Tambopata, Madre de Dios

Cajamarca Special Office

Jr. Junín N° 836, Cajamarca, Cajamarca

Chimbote Special Office

Av. Francisco Bolognesi N°469, Chimbote, Ancash

Tacna Special Office

Calle Apurímac Nº 201 – Tacna, Tacna

Moquegua Special Office

Esquina Calle Moquegua con Mariscal Nieto N° 802, Ilo, Moquegua

Arequipa Special Office

Av. Ejército N° 101, Oficinas 111, 201 y 202, Edificio Nasya, Yanahuara, Arequipa

Arequipa Special Office

Cooperativa La Cantuta Mz. A, Lt 27, Arequipa, Arequipa

Tacna Special Office

Calle Apurímac Nº 209 – Tacna, Tacna

Trujillo Special Office

Av. 28 de julio N° 130 – 132, Trujillo, Trujillo